Q3 2025 Market Update: Fiscal & Monetary Policy and A Disconnect Between Valuations & Fundamentals

The Yes Wealth Team

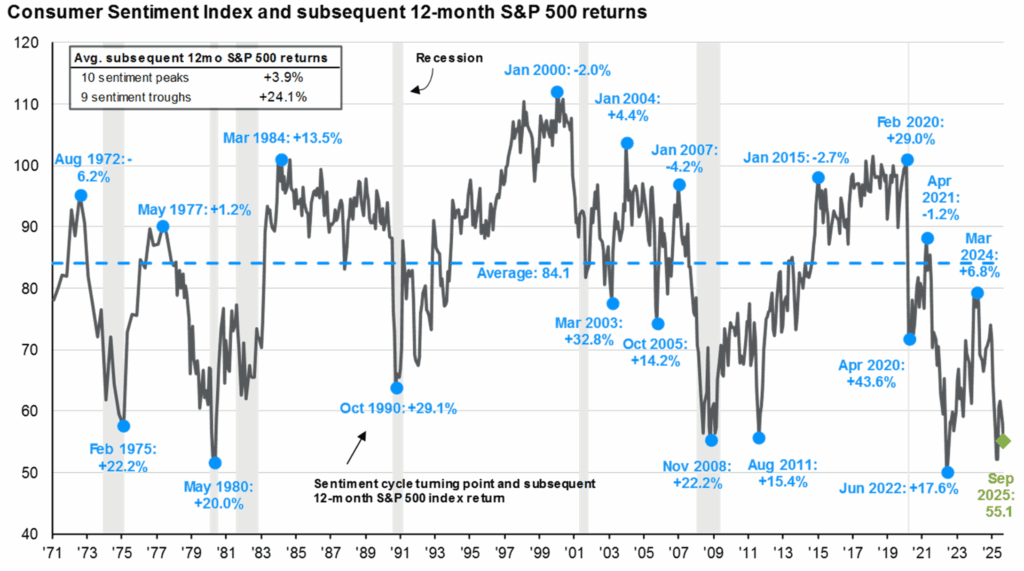

What an interesting year! It seems that the disconnect between the economy and the market is unusually large. Consumer sentiment is near an all-time low while the U.S. stock market is at an all-time high! It is usually better to invest when sentiment is low rather than when it is high.

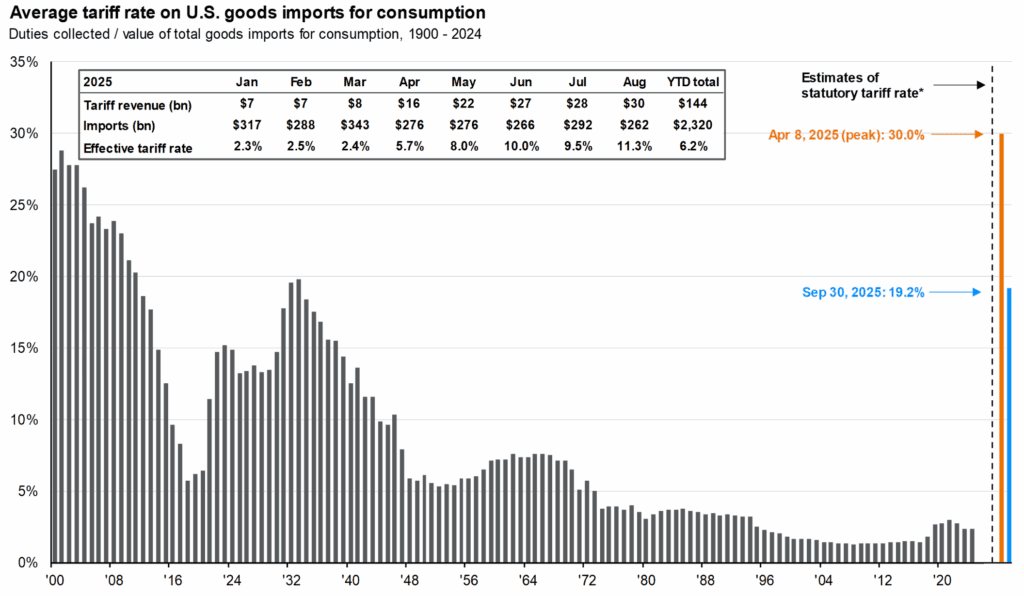

⏪ Fiscal policies creating headwinds for the economy are tariffs, immigration shut down and rising deficits (government overspending).

⏩ Fiscal and Monetary policies creating tailwinds for the economy include interest rate cuts, deregulation and stimulus from Tax Bill.

⚖️ There appears to be a disconnect between valuations and fundamentals which require the strategies of diversification and risk management.

- Consumer Sentiment has been this low rarely in the past and can represent a turning point in stock market performance. Normally consumer sentiment tracks with market performance:

Source: JPM Q4 Guide to the Markets

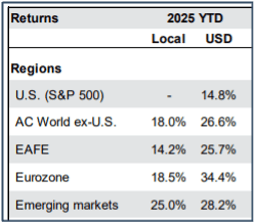

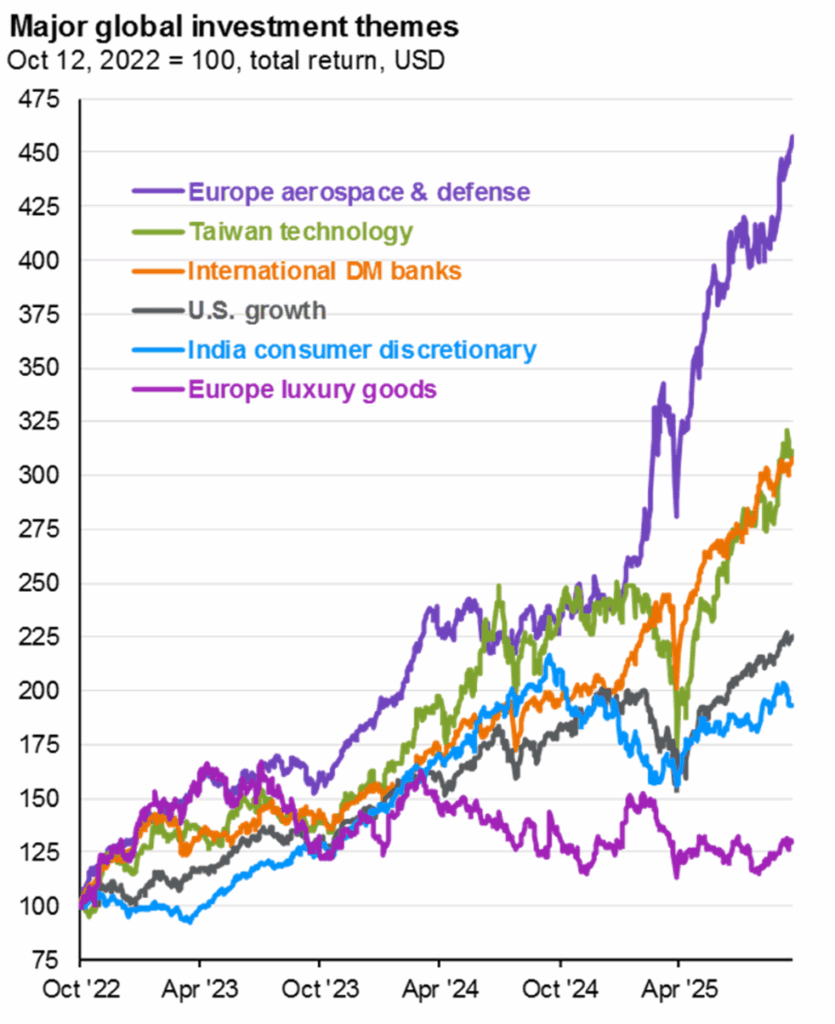

- Stocks: Market Performance is a positive Global affair in 2025!

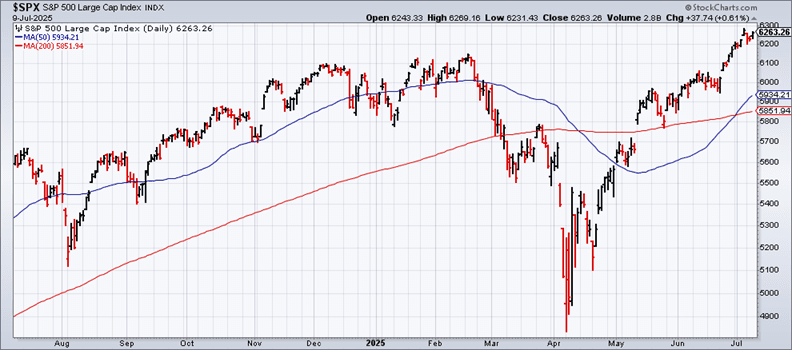

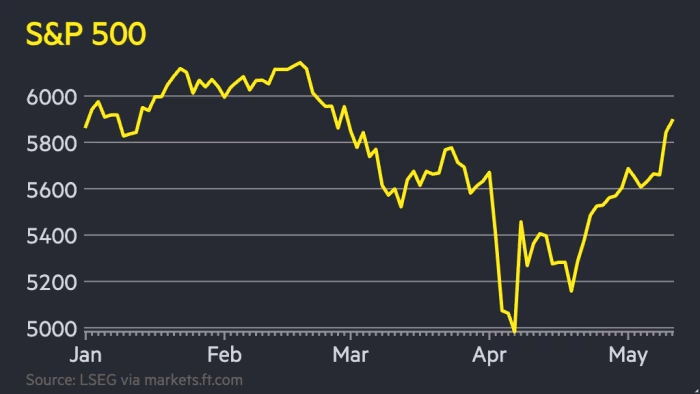

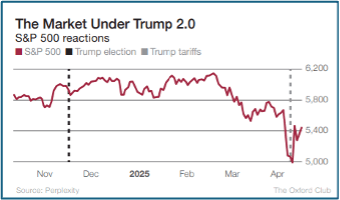

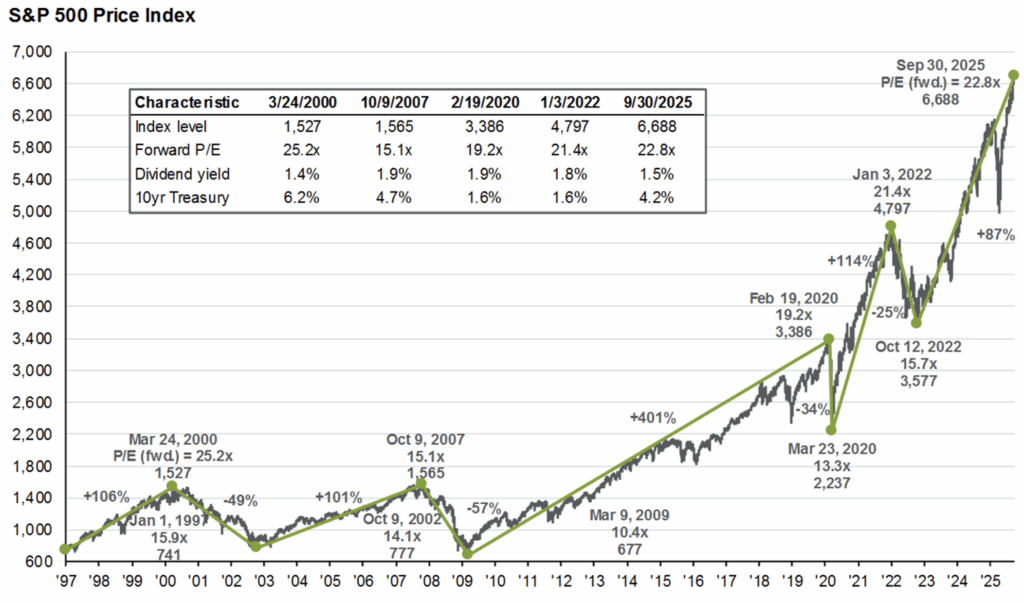

- S&P 500 hit a record high on Sept. 22 [6694] to close the quarter at 6688 +14.8% YTD. Right chart above

- International equities continue to be the star performers of 2025!

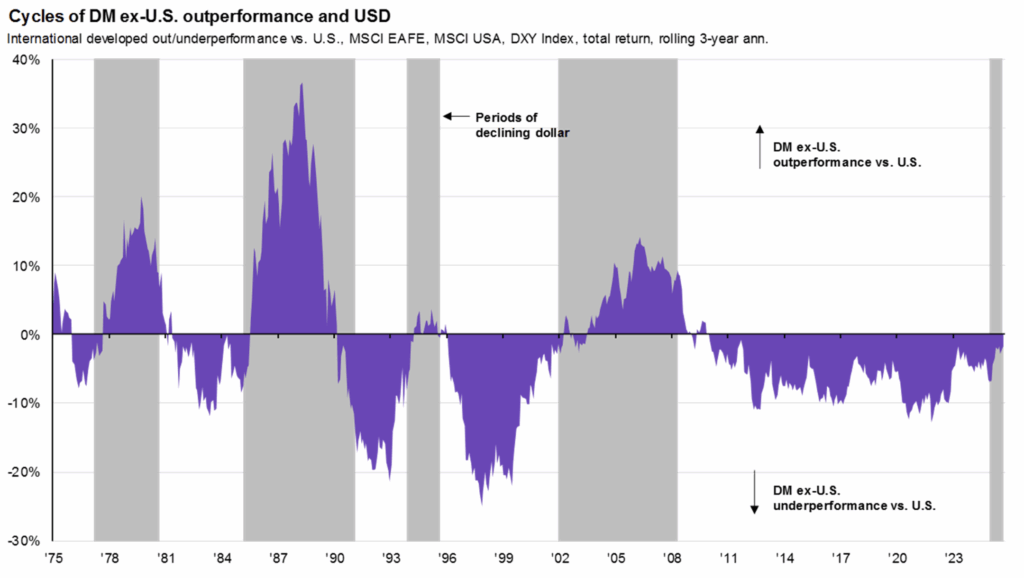

- The left chart below reflects the market performance in local currencies and translated to U.S. dollars. The impact of U.S. dollar depreciation is evident in the stock prices. For example, EU stocks were up 18.5% YTD through 9/30 in Euros, but they appreciated by 34.4% in U.S. dollars

- The middle chart shows global investment opportunities in our portfolios today.

- The right chart below shows why most portfolios have been underweight international equities for some time:

Source: JPM Q4 Guide to the Markets

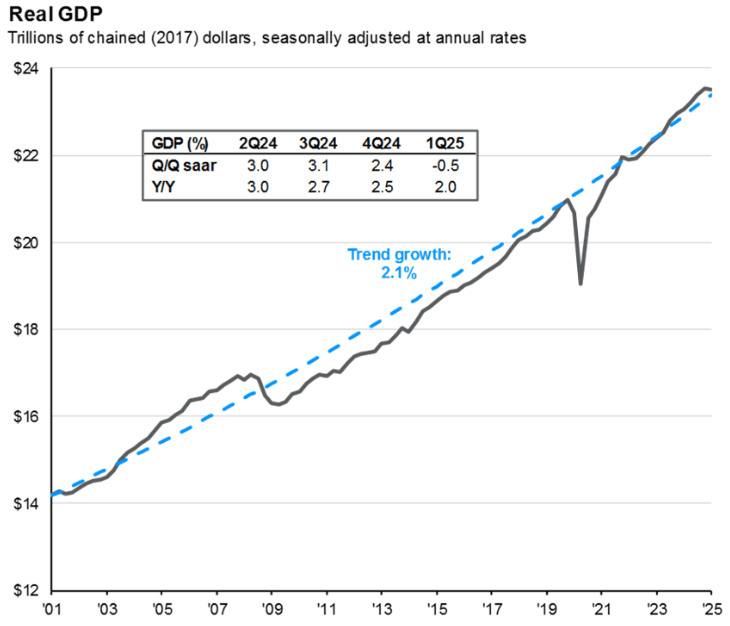

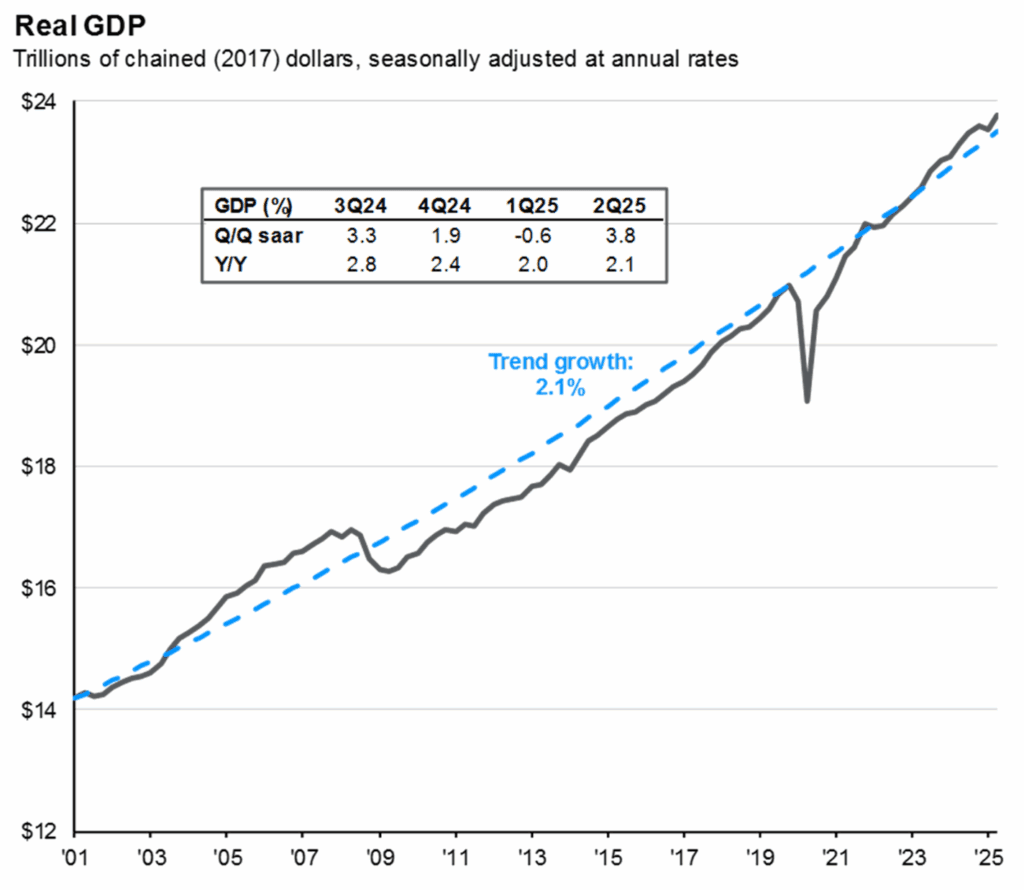

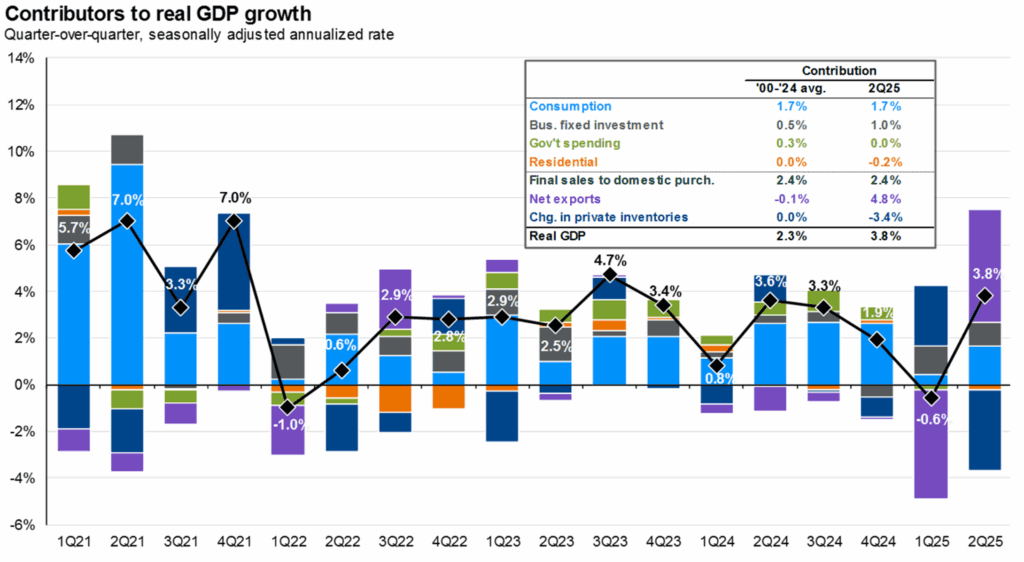

- Economic Growth (GDP) grew aggressively in Q2 {+3.8%} after declining by -0.5% in Q1.

- The right chart below highlights the impact of tariffs on economic growth. Net exports represented by purple bar are exports minus imports. Higher imports have a negative impact on U.S. economic growth because we are consuming product not made here, while exports have a positive impact.

- Companies loaded up inventories in anticipation of tariffs in Q1 and then dramatically reduced them in Q2.

- Estimates for Q3 are not yet available, but the expectation is for solid growth

- No Recession continues to be the likely case for 2025 and well into 2026

Source: JPM Q4 Guide to the Markets

Q3 and YTD Highlights

- Tariff Impact: tariffs had a big impact on companies who are importers but for the most part, companies absorbed some of the cost while also passing some on. They also worked on long-term supply chain solutions to avoid this expense in the future. Consumers can expect to see more of the cost increases passed through to them in the coming months

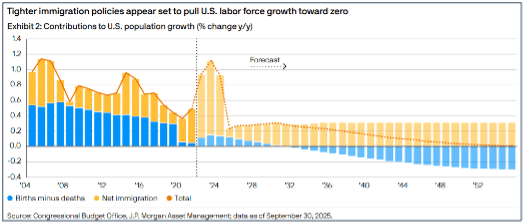

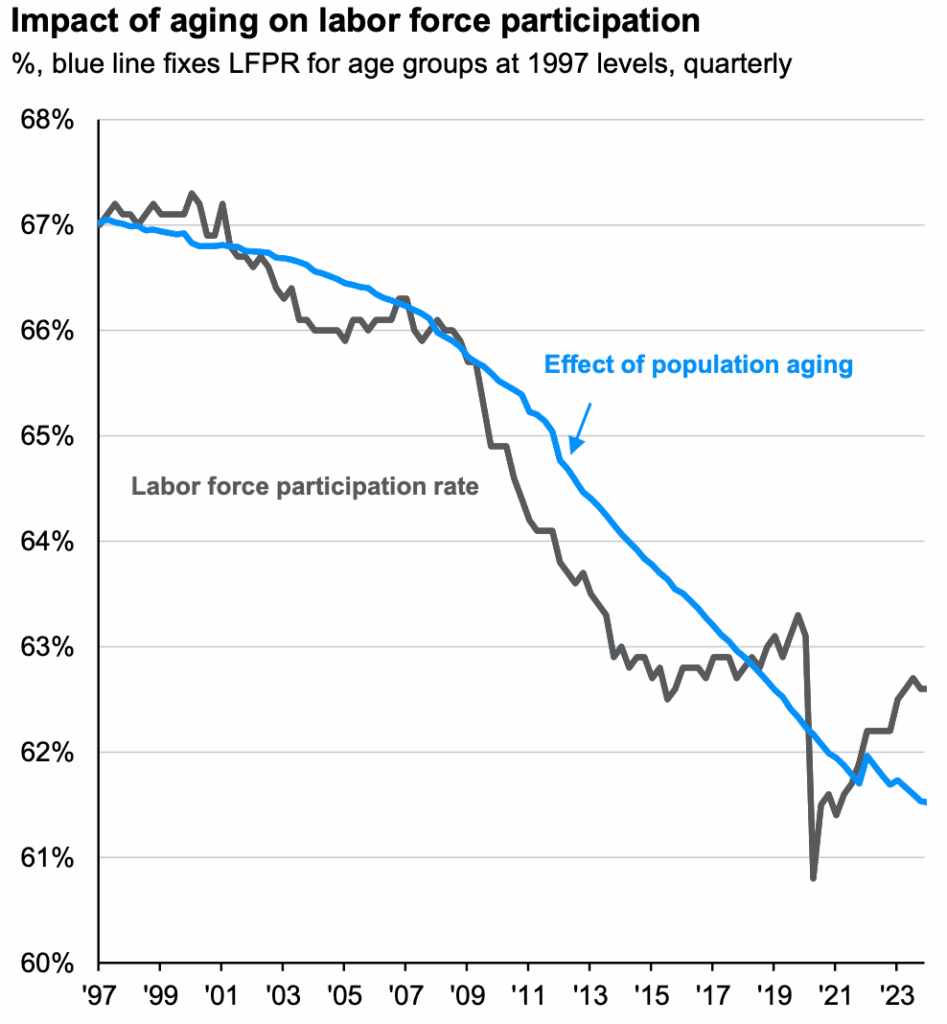

- Immigration and Demographics: Tight immigration policy and demographics are contributing to tight Labor force supply Our current path is leading to zero U.S. labor force growth, causing economists to reduce their economic growth forecasts.

Source: JPM Q4 Guide to the Markets

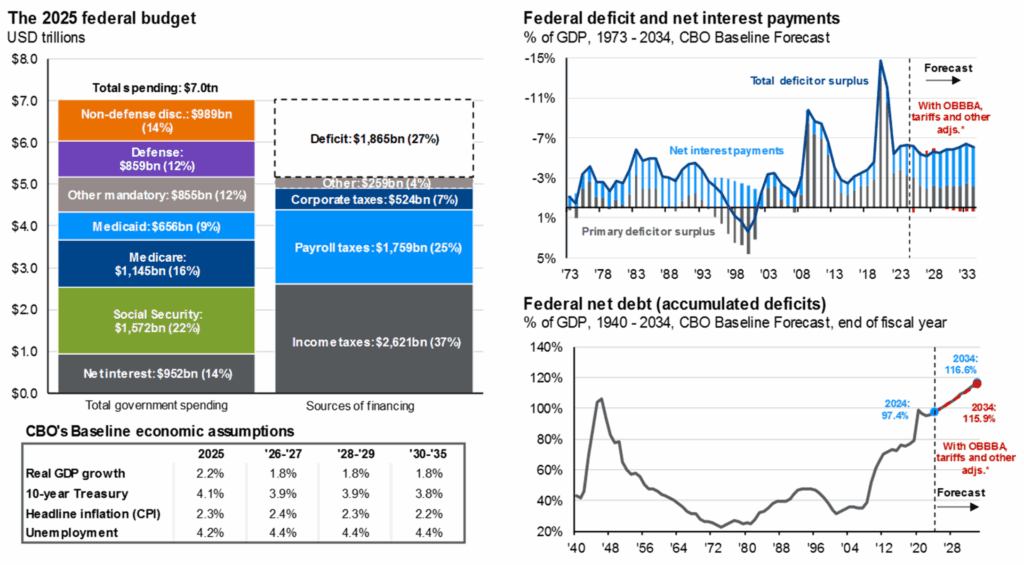

- Budget Bill passed: Tax cuts will provide stimulus, and deregulation will help corporate investment. What we aren’t talking about is the growing size of the U.S. deficit and the cost to finance it. JPM’s Dr. David Kelly said, “We are going broke slowly”. Look at the size of Net Interest payments!

- Household (consumer) debt also hitting record highs: Total HH debt hit $18.4 Trillion in 2025 (70% in mortgages – $12.9 T; Auto loans $1.66T, Student loans $1.64T and credit card debt $1.2T). Debt being driven by high interest rates and inflation, and delinquency rates are increasing as could be expected. Implications: reduced consumer spending and potentially tighter lending standards. Most affected are lower income households, younger generations, and women.

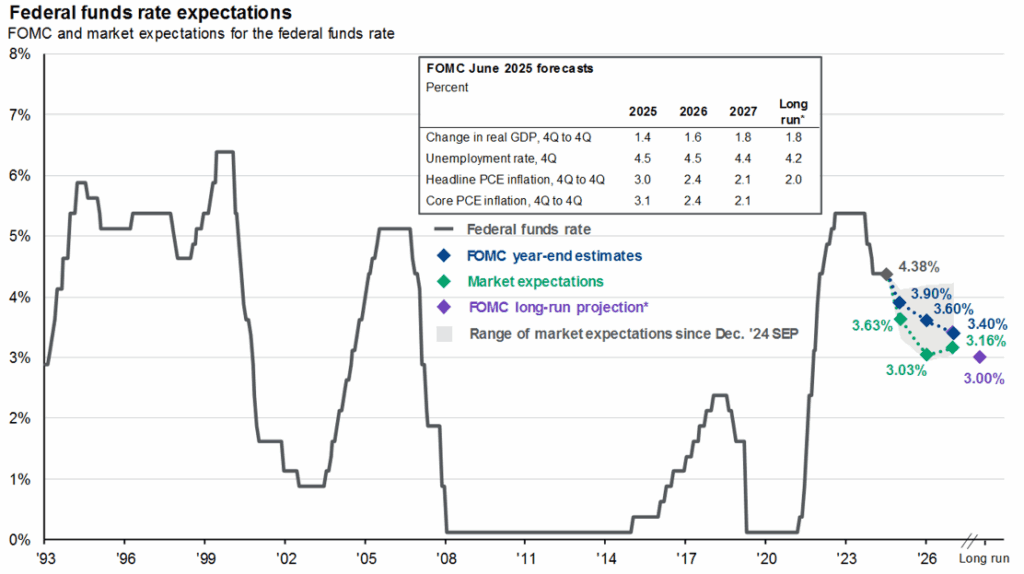

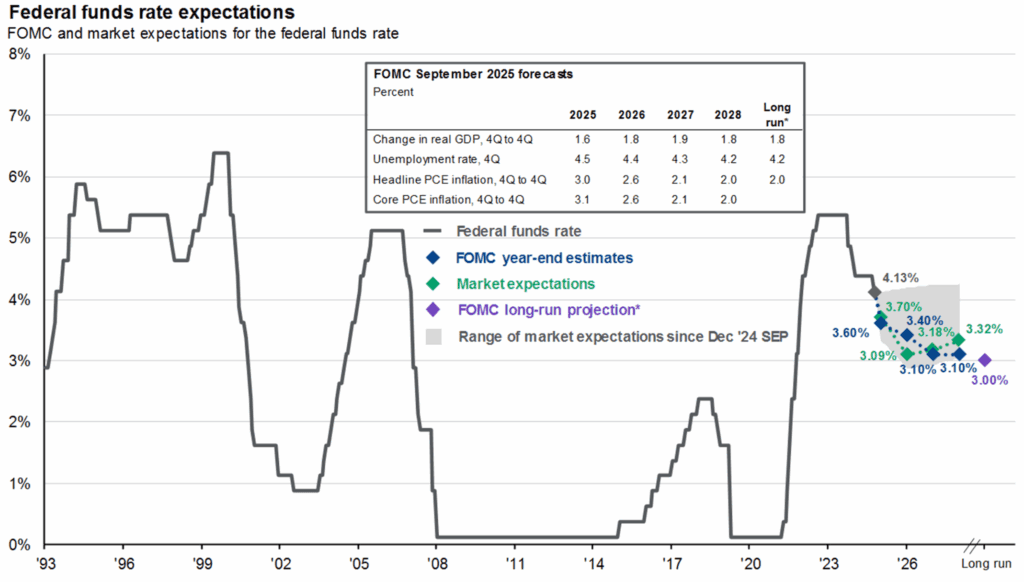

Monetary Policy

- Interest Rates: Fed cut short-term interest rates by 25 basis points (0.25%) in September for the first cut in 9 months to a range of 4% to 4.25%.

- Market forecasters expect an additional two cuts in 2025 and another two rate cuts in 2026

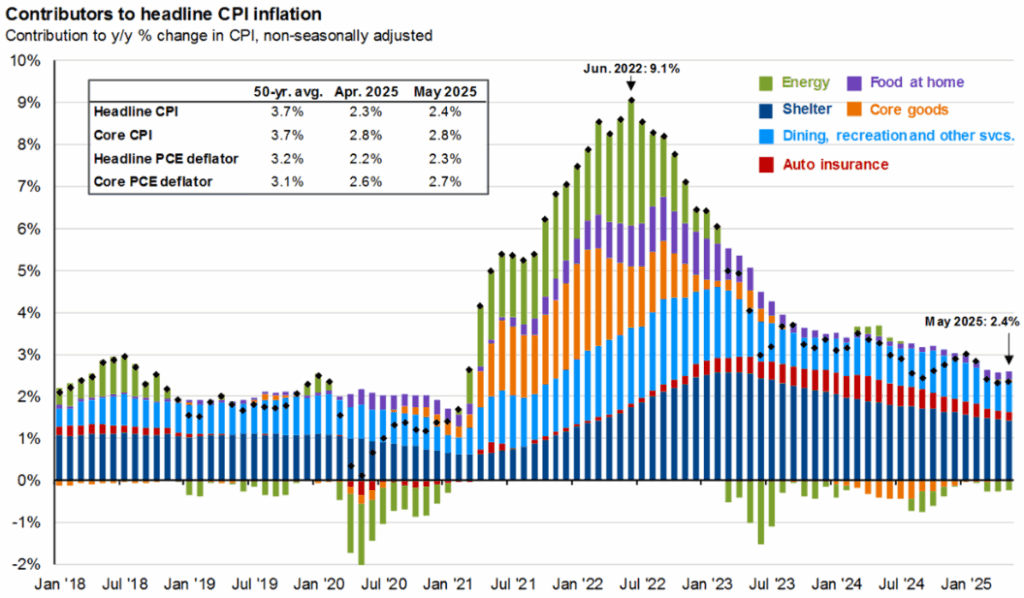

- Federal Reserve Mandates: Two main mandates – keeping Inflation low at ~2% (see right chart above) and unemployment steady, currently historically low at 4.3%. Inflation just increased from 2.9% to 3.0%, below expectations that tariff increases get passed on to consumers.

- 10-Year Treasury Yield ended quarter at 4.15%: This represents the market perspective on inflation which the Fed does not control. So far this year, the yield is down 2.45%, signifying lower inflation expectations by the market.

- U.S. Dollar declined by 10.6% versus other global currencies when President Trump announced his tariff plan (raised inflation expectations and reduced growth expectations) and investors anticipated that the Fed would cut rates. For these reasons, many expect the value of the dollar to continue to decline over time.

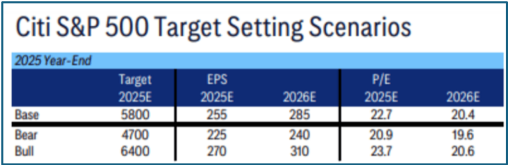

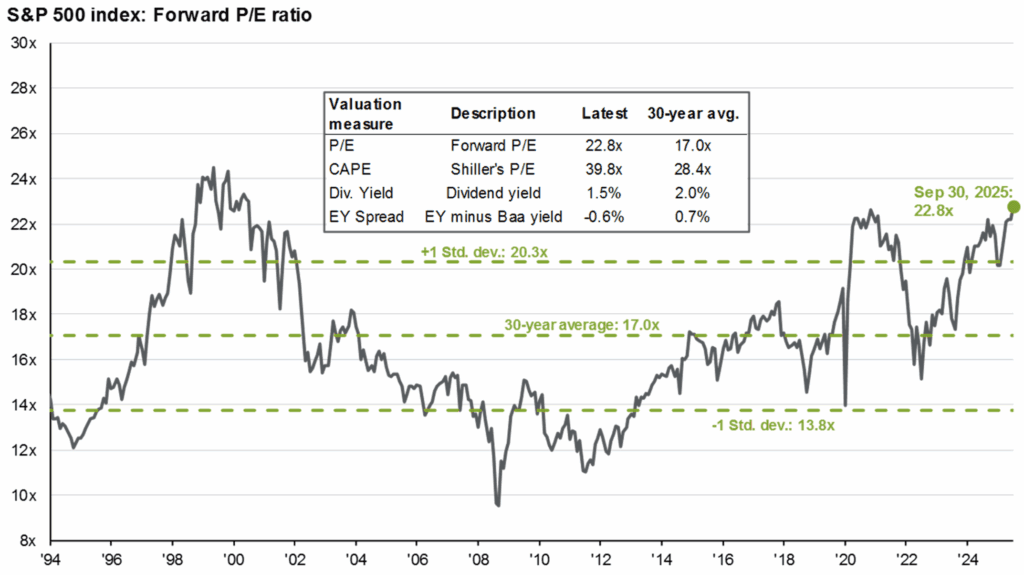

- Valuations: Headlines are screaming about how over-priced U.S. stocks are right now!

- Left chart below shows S&P 500 ended Q3 at 22.8 times earnings which is historically high

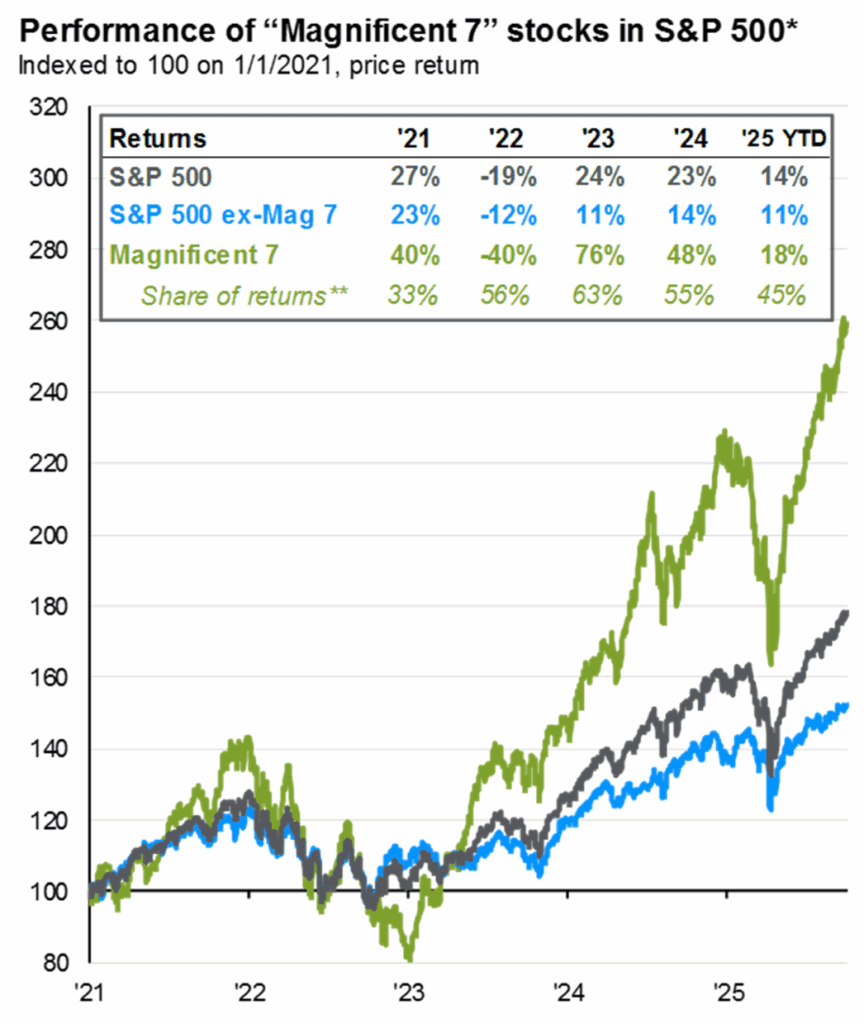

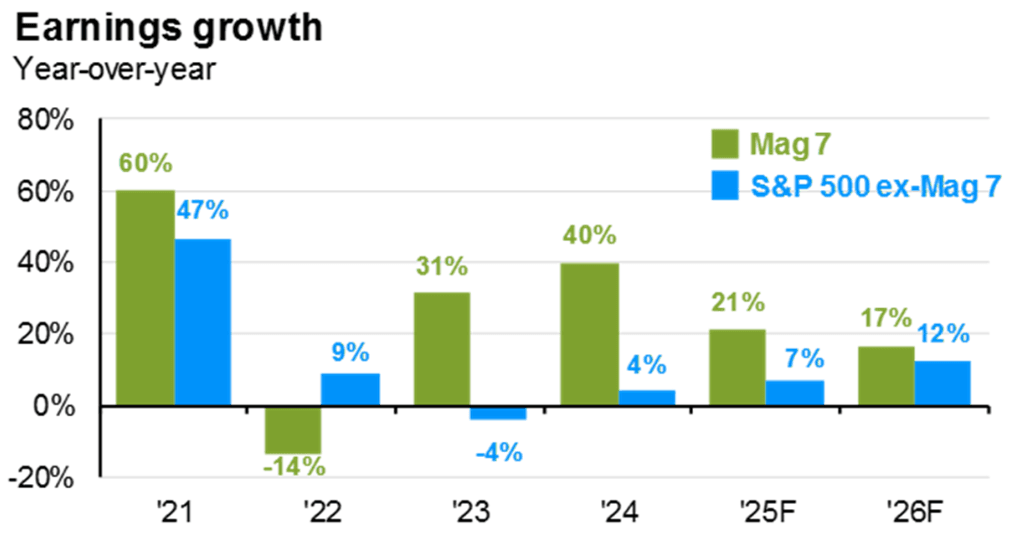

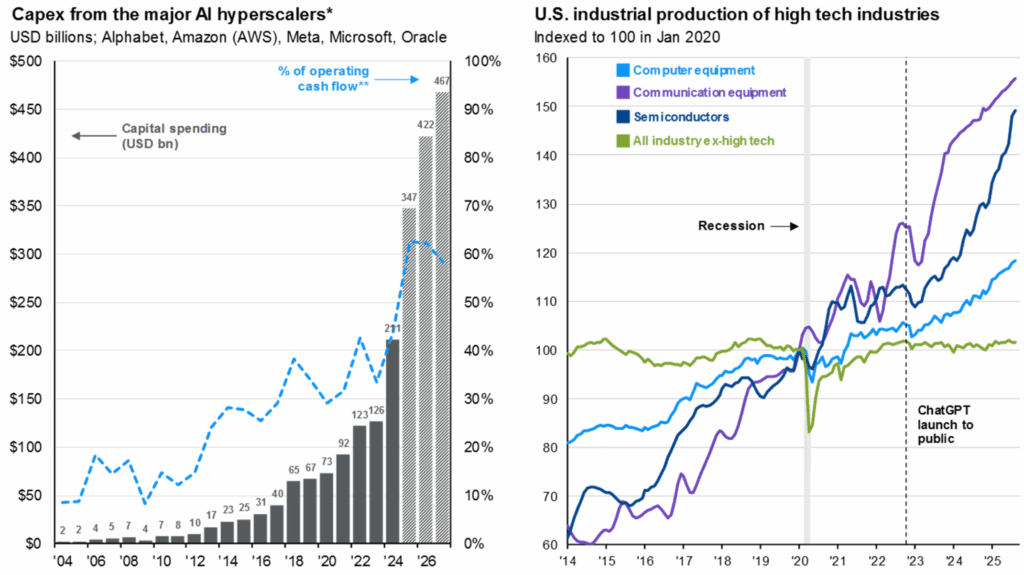

- Mag 7 stocks continue to power the S&P 500 behind the strength of global AI capital investment

Source: JPM Q4 Guide to the Markets

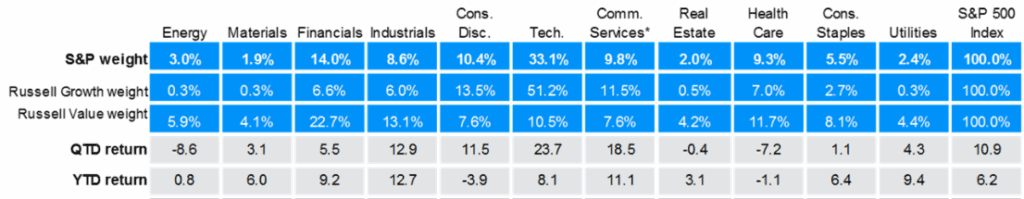

- Other Sectors driving YTD growth include Comm Services +24.5%, Industrials +18%, Utilities +18%

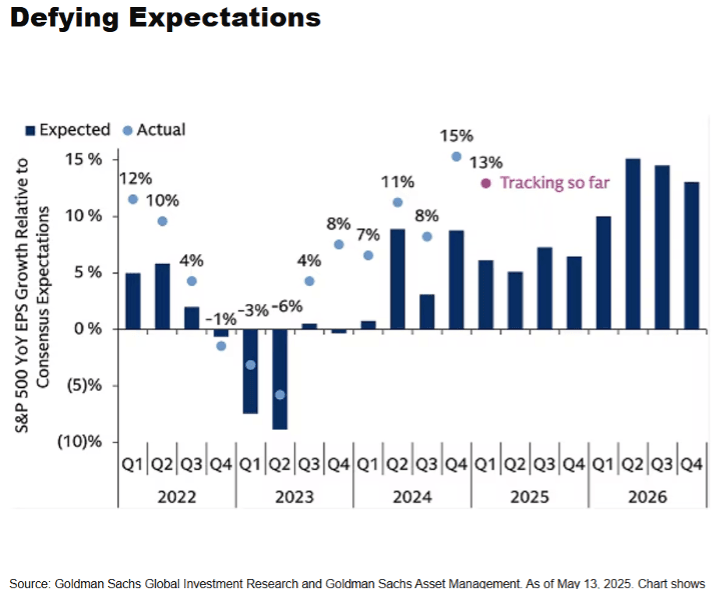

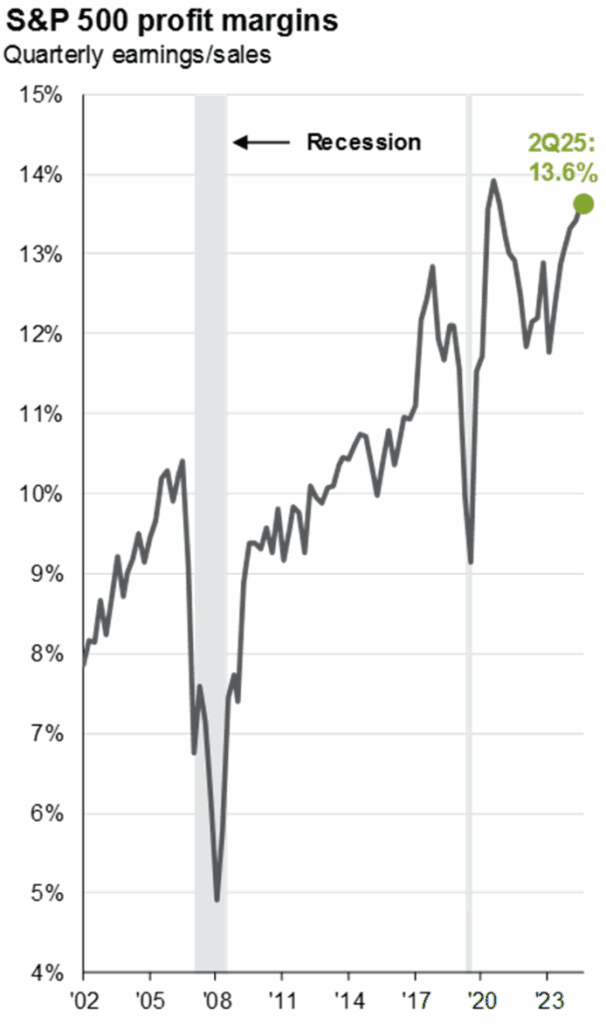

- Profit margin forecasts continue to strengthen (left chart below) with the other 493 companies beginning to show double digit earnings growth and catching up to the Mag 7 companies

- S&P 500 margins continue to improve, resulting in growing earnings (right chart below)

Source: JPM Q4 Guide to the Markets

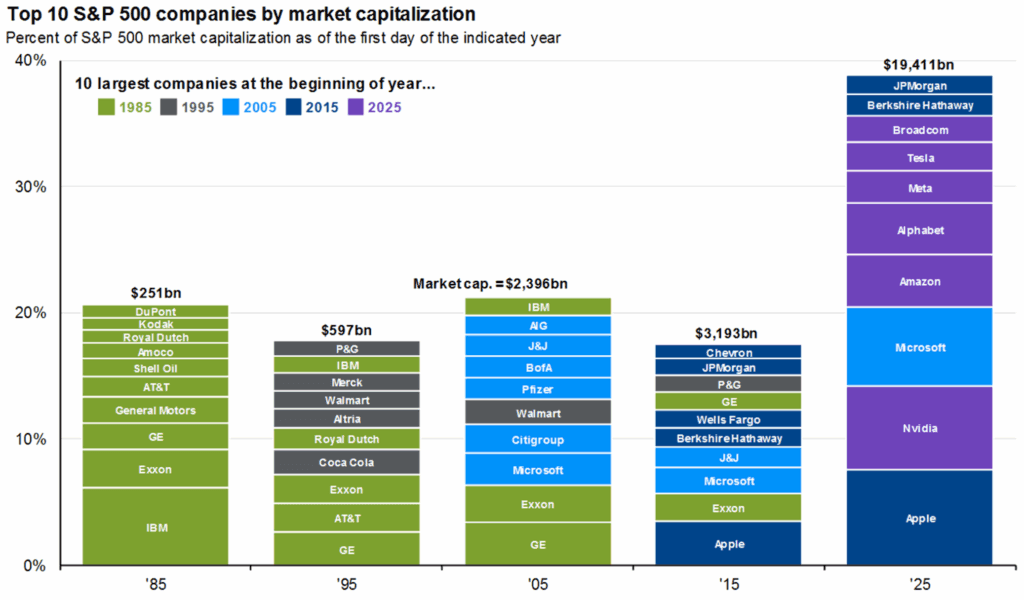

- Artificial Intelligence’s major impact on the stock market has been covering up slower growth rates in the rest of the market.

- The chart below shows the ten largest companies by market cap over the last five decades

- Three companies stayed on the list over the last decade and only one company (Microsoft) has stayed on the list for two decades.

- Shows the power first of the internet and more recently AI investment

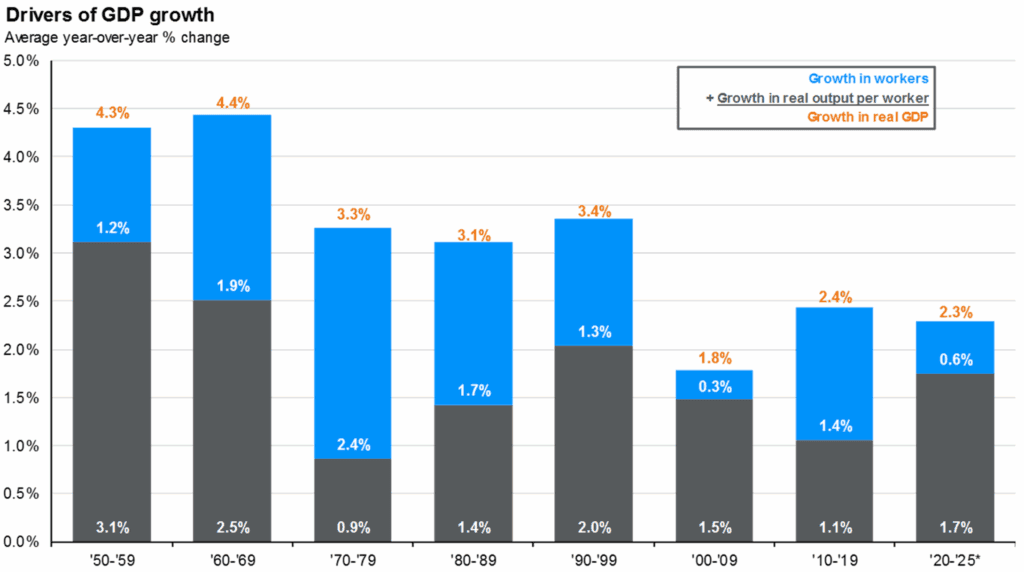

- Some explanation of economic key drivers could help us understand the power of AI

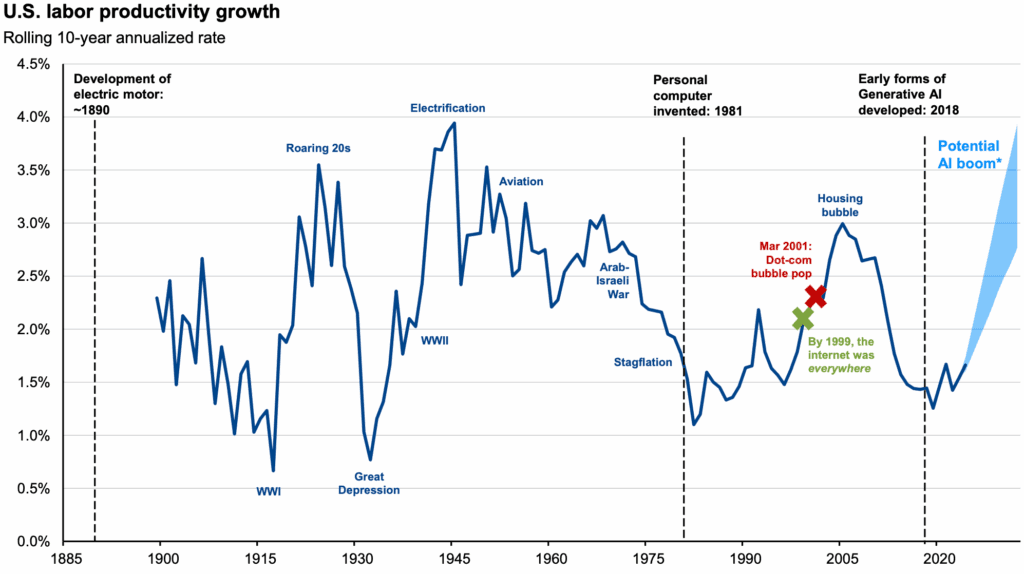

- Economic growth is growth in workers plus growth in productivity per worker (left chart below)

- Labor force is declining due to a population aging which results in less economic growth in workers (middle chart below)

- Labor force productivity becomes a key driver of growth with expectations that AI will be a major driver (right chart below)

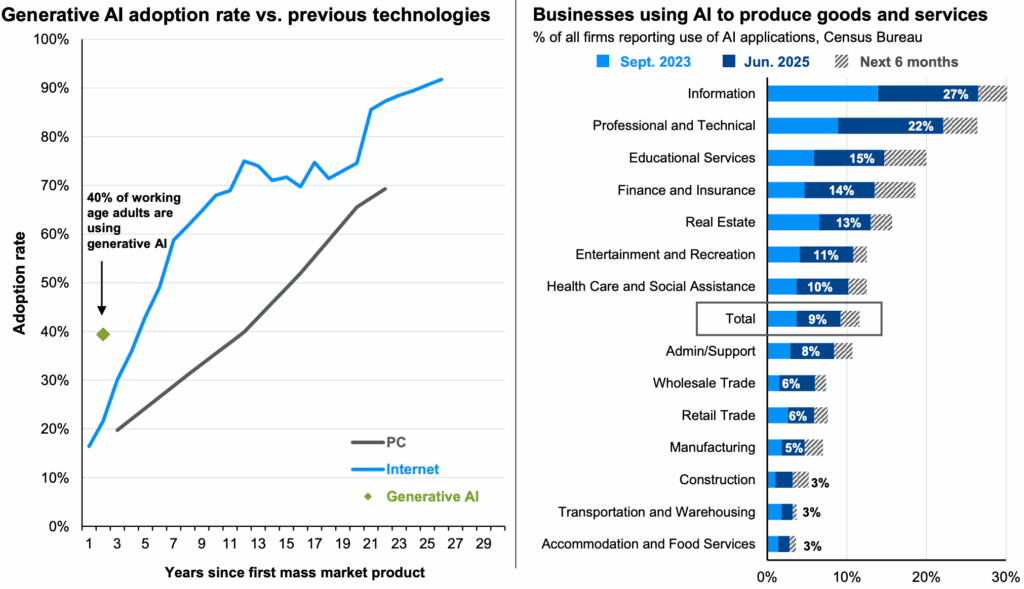

- The adoption of AI technology so far has been extremely rapid, yet with plenty of room left for businesses to figure out how to use the technology to drive down their costs (left chart below)

- There has been astounding level of investment by industry in the infrastructure required to power AI, from chips to data centers and data storage capabilities, to energy generation of all types!

- The perspective that AI could be in a bubble does get us thinking about diversification. We don’t like the idea of missing out on the investment returns, but a drop in valuation when it comes most likely will be rapid.

Market uncertainty is the certainty we confront, forcing us into decision-making in the market fog. As always, we as Investors face two competing instincts: either staying the course or attempting to time the market. We know from experience that amid heightened volatility, making reactionary moves can be risky. We believe Portfolio decisions should align with individual risk tolerance and individual investment time horizons.

Our current approach includes:

- Increasing diversification between value and growth, U.S. and International, and using Alternatives

- Maintaining bond durations in the 4 to 6-year range – given potential inflation impact on interest rates on elevating bond yields going forward and continued volatility in 10-year bond yields.

- Staying disciplined – we have learned that the best approach for long-term investors while market headlines may evoke strong emotions, we encourage investors not to overreact to short-term swings.

Asset Allocation Adjustments

- U.S. Equities

- We are adjusting portfolios to a diversified approach in large-cap U.S. equities while incorporating more mid-cap and value exposure and giving AI-driven opportunities full consideration.

- Tariff implications on tech remain a concern, but the sector’s long-term outlook – particularly driven by AI adoption and productivity gains – must be balanced against policy uncertainties.

- We have adjusted our hedging strategies from sole reliance on puts for downside protection to also utilize calls for income generation to help protect against downside.

- International Equities

- We have increased our position weight in developed international markets, while increasing value sectors.

- We are maintaining emerging markets as equal weight but continue to be underweight China.

- Fixed Income

- Fiscal pressures and high real interest rates are expected to keep US bond yields elevated.

- Bonds play a role in portfolio diversification and offer attractive income streams

- Our strategy is holding bonds to maturity, slightly extending durations in high-yield and corporate bonds (4–6 years) to capture pricing upside when interest rates eventually ease, and to add in actively managed multi-sector funds as appropriate to portfolios.

- Fixed income alternatives offer a significant variety of strong investments, and we will continue to leverage them strategically. We have identified options in private credit that provide access to more varied investment structures across the Private Credit landscape rather than just senior loans via direct lending. These opportunities do have some liquidity restrictions, but come with lower volatility, higher returns with risk levels equal to High Yield Corporate bonds for long-term investors.

Questions?

Interested in learning more? Reach out to your advisor for a more in-depth discussion.

Not a client? No problem! Get in touch with us here: Contact Us

Important Disclaimers:

This content is intended solely to provide general information about Yes Wealth Management and its services, and to offer an overview of our investment philosophy and strategies. It is not intended to offer or deliver investment advice in any way. Direct consultation with a financial professional, who has full knowledge of your financial situation, is essential in determining how to apply these principles and strategies to your personal situation. Market data, articles and other content in this post are based on generally available information and are believed to be reliable – however, Yes Wealth Management is not in a position to be able to fully guarantee the accuracy of all cited information contained in this post. Financial professionals at Yes Wealth Management rely on a wide range of sources to determine market conditions and appropriate strategies for each client, and as such the individual sources cited in this blog should be used for descriptive and informational purposes only.

Please review our full list of disclosures here: https://yeswealth.com/important-disclosures/