Update on the Post-Tariff Investment Landscape

Buy the Dip? / Recession? / Stagflation?

What’s an Investor to do?

THE YES WEALTH TEAM

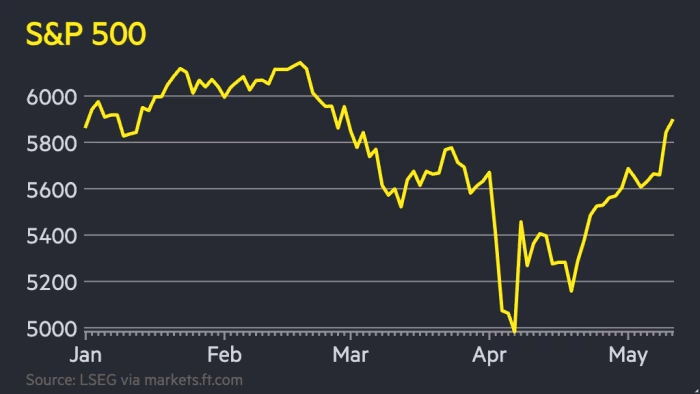

First the good news: A Recent Rally

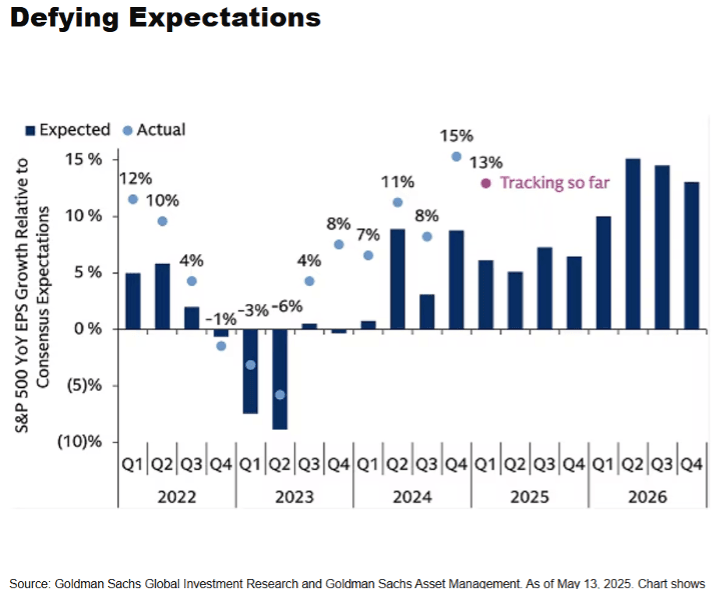

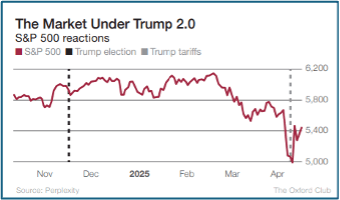

- The S&P 500 rallied nearly 20% in under six weeks, bouncing back from the edge of a bear market to a +1.3% year-to-date gain.

- Long-term interest rates are close to their levels at the start of 2025.

- The U.S. Dollar is down 8% year-to-date, enhancing global competitiveness for U.S. exports.

- This rally has been driven by several factors: a pause in tariff policies, strong Q1 earnings (+13.3%), resilient economic hard data, and the implied fiscal stimulus within the budget reconciliation bill currently taking shape in Congress.

Areas Warranting Caution:

Despite the recent rally, caution is warranted due to several developing trends:

- Tariffs are higher than at the start of the year – averaging 13.3% – with pauses set to expire in early July and early August. This Policy Uncertainty is delaying business decisions which earlier this year got us close to the Bear Market.

- Falling immigration (both illegal and legal) is expected to negatively impact the U.S. labor supply.

- While not currently in the headlines, projected government spending cuts will likely temper near-term economic growth.

- The Reconciliation Budget Bill stands as the single biggest policy issue, with the potential to further increase the already historic budget deficit.

Economy and the Fed: A Closer Look:

Attention is now shifting to the broader economy and the Federal Reserve’s stance:

- We are beginning to observe softness in both consumer and business sentiment.

- Economic growth in Q1 was negative (-0.3%).

- Q2 Growth is expected to be only slightly positive, as falling imports (due to tariffs) may not offset domestic growth as they normally do.

- Monthly payroll job gains are anticipated to fall to 100,000 or lower. This could lead to a rise in unemployment to 4.5% from the current 4.2%, especially given labor force constraints from reduced immigration.

- Expect inflation to pick up in Q2 2025.

- Corporate profits are projected to slide, though they should remain positive after the strong +13.2% year-over-year growth in Q1.

- This economic outlook suggests the Fed could end up further from its 2% inflation goal than from its unemployment target. Consequently, we anticipate only one interest rate cut in 2025 and little to no change in 2026.

Investment Implications

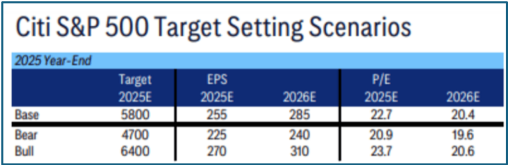

Today we often hear about recession fears and even “Stagflation” fears. Both are periods of economic difficulty, but have different causes, indicators and implications. In brief, if the economy is slowing or shrinking with low inflation it’s likely a recession. If the economy is barely growing (or not at all), with high inflation and unemployment, it’s stagflation. Either situation would suggest that we make adjustments in our investment approach, but we do not see these as high probability events at this time.

The diminishing uncertainty around government policies points to a clearer path: higher tariffs, lower immigration, and government spending cuts will collectively dampen economic growth. However, a moderation in tariffs, combined with the fiscal stimulus from the Budget Reconciliation and potential tax cuts should help the economy avoid a near-term recession.

These policies, however, have the potential to reduce the long-run growth rate of the U.S. economy, increase the budget deficit, and modestly raise inflation. This combination poses a risk for highly valued mega-cap U.S. equities that have recently driven the S&P 500.

Therefore, we continue to favor diversification to navigate this challenging environment. Our focus remains on increasing exposure to International Equities (attractive relative valuations, fiscal stimulus, and dovish monetary policies) and U.S. Value Stocks (high quality, dividend-paying). Given the potential inflation headwinds, we are also maintaining shorter bond durations.

As David Giroux of T.R. Price wisely noted:

“You shouldn’t invest based on how you feel today because your feelings (and markets) will likely be very different six months from now.”

We must remember that uncertainty is inherent to investing. The key is to assess whether that uncertainty is trending positively or negatively. Until we have greater clarity, we will maintain a cautious, diversified tactical approach.

Important Disclaimers:

This content is intended solely to provide general information about Yes Wealth Management and its services, and to offer an overview of our investment philosophy and strategies. It is not intended to offer or deliver investment advice in any way. Direct consultation with a financial professional, who has full knowledge of your financial situation, is essential in determining how to apply these principles and strategies to your personal situation. Market data, articles and other content in this post are based on generally available information and are believed to be reliable – however, Yes Wealth Management is not in a position to be able to fully guarantee the accuracy of all cited information contained in this post. Financial professionals at Yes Wealth Management rely on a wide range of sources to determine market conditions and appropriate strategies for each client, and as such the individual sources cited in this blog should be used for descriptive and informational purposes only.

Please review our full list of disclosures here: https://yeswealth.com/important-disclosures/

About US

Yes Wealth Management has provided trusted quality investment advice to individuals and financial institutions for over 30 years. Our experienced team creates investment portfolios that help our investors to minimize significant downside risk while participating in upside returns through the use of a range of modern investment options and risk management approaches that are suitable for each client’s unique situation.