Q2 2025 Market Update: A Rally, Risks, and What’s Ahead

The Yes Wealth Team

We agreed with Priya Misra from JPMorgan that, “It was a quarter that felt like a year!”

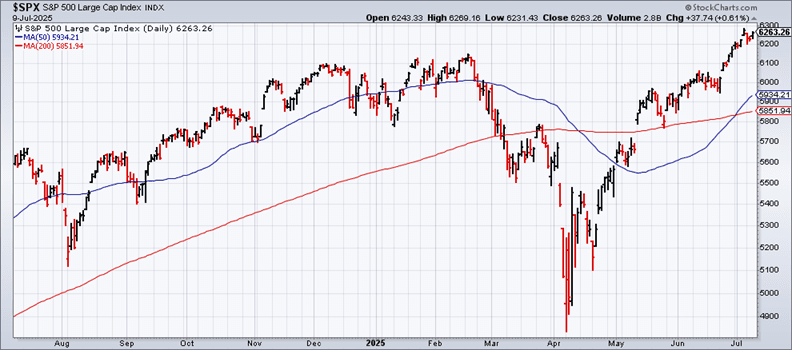

The quarter was full of surprises, from “Liberation Day” when President Trump announced his tariff plans that plunged the U.S. stock market to the brink of a bear market (-20% decline) to hitting a stock market high just three weeks later when he put many of the tariffs on “pause.” Now tariffs are back, and pundits are arguing about whether tariffs will cause inflation (they will) and whether the Fed will cut rates to help economic growth (they probably won’t).

While there is Monetary Policy uncertainty from the Fed, Fiscal Policy uncertainty has been resolved with the passing of the budget bill, tightening immigration policies, and the ever-rising government deficit.

- S&P 500: Overcame major volatility in the quarter by growing +10.8% in Q2, resulting in +6.1% growth YTD.

Drivers:

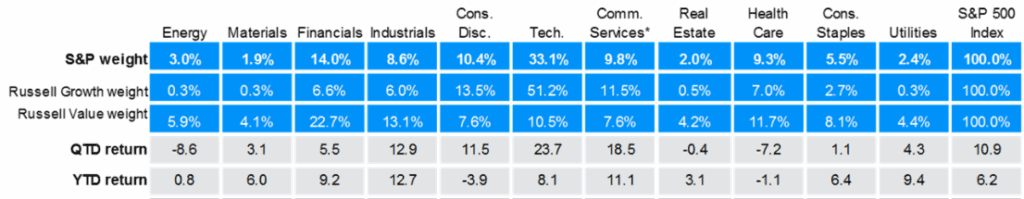

- Strong corporate earnings (78% of companies beat estimates).

- Tech and AI sector rally despite the risk caused by tariffs on their supply chains

- Lowered earnings expectations helped companies beat forecasts.

Fiscal Policy

- “One Big Beautiful Bill” Budget Bill passed: Tax cuts were made permanent, deregulation was a key objective, but massive increase in spending is projected.

- Tariff Uncertainty: Tariff uncertainty was paused when deadlines were extended to Aug 1; however, the administration has ramped up the rhetoric and threats when they sent new tariff letters in July to countries who have not finalized new trade terms with U.S.

- Immigration Cuts: Trump administration has been successful in closing off illegal immigration as desired but has also dramatically reduced legal immigration. Half of U.S. growth in labor supply in 2023 and 2024 was supplied by immigrant workers, which led to strong economic growth.

Monetary Policy

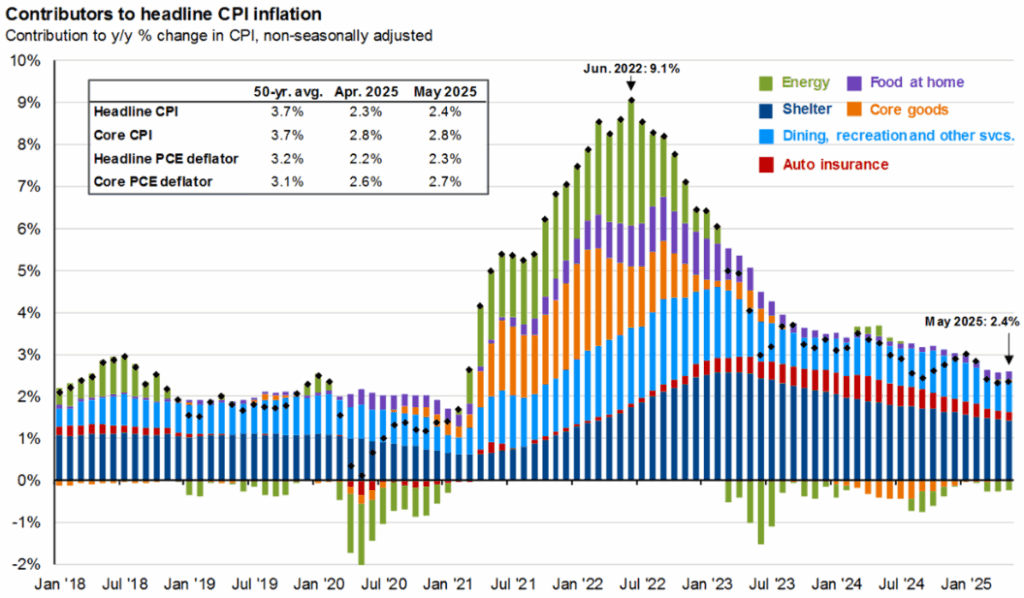

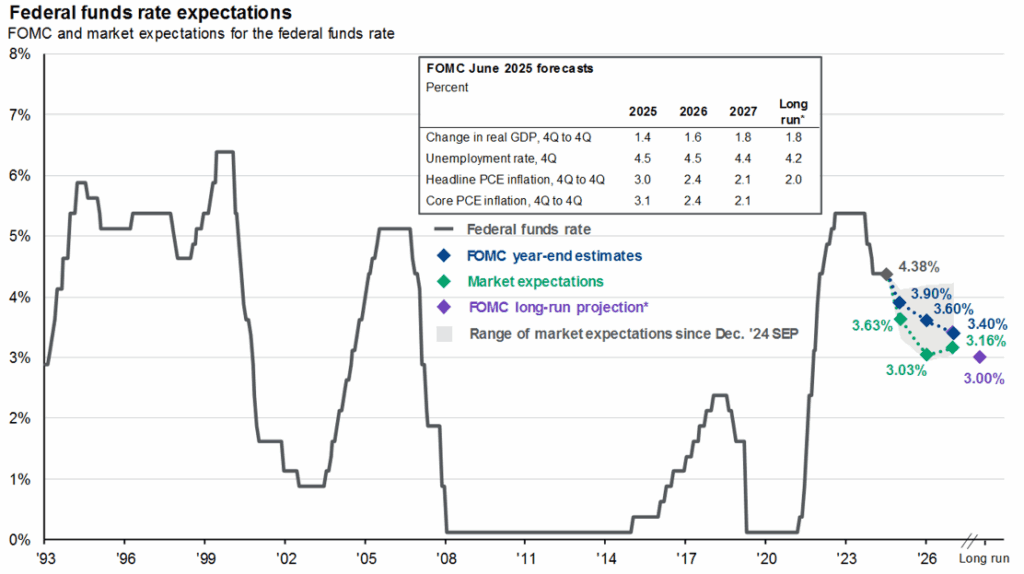

- Fed on Hold: The Fed has two main mandates – keeping Inflation at ~2% and unemployment steady, currently historically low at 4.1%. They have stated that they will wait to see hard economic data reflecting the impact of the tariffs on inflation before making any rate cuts.

- Rate Cut Expectations: We find it interesting that the “market” still expects 1–2 cuts in 2025 and possibly 1 in 2026.

- 10-Year Treasury Yield: This represents the market perspective on inflation which the Fed does not control. So far this year, the yield is down 2.45%, signaling lower inflation expectations by the market.

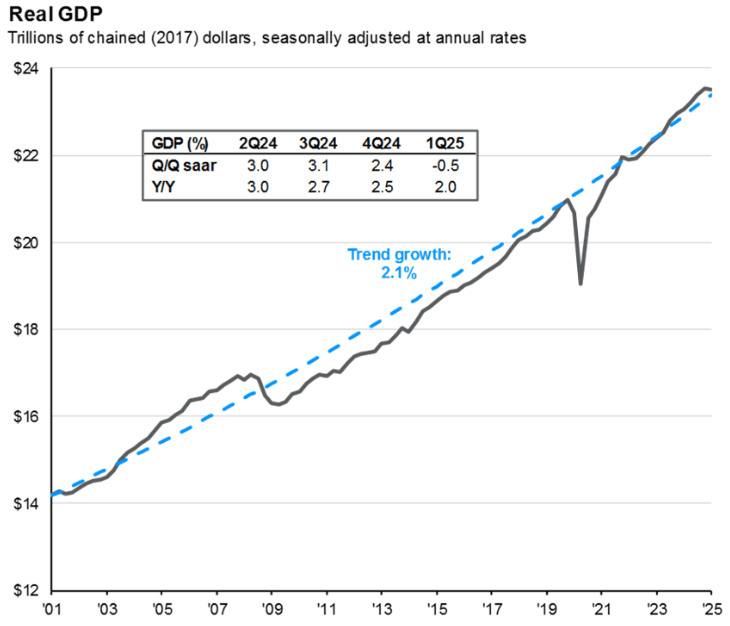

- Economic Outlook was dominated by the impact of dramatic policy changes on a relatively slow growing U.S. economy that will most likely further reduce economic growth and raise inflation.

- No Recession is the Likely Case: However, risks remain elevated. It is quite possible that the inflationary impact of the tariffs could impact consumer spending more than the stimulus from the tax cuts – but this remains to be seen.

- Deficit: What concerns everyone is the apparent impact of the budget bill of dramatically increasing the budget deficit from 98% of U.S. GDP today to 126% by 2034.

- Energy Prices: -8.9% in Q2, easing inflation despite Middle East conflict.

⛈️ Headwinds

- Tariffs have the potential to significantly increase inflation which will lead to reduced consumer spending.

- Labor shortages due to immigration cuts could hurt economic growth.

- Rising U.S. debt requires an increasing slice of annual government spending, and the new budget is projected to hit 126% of U.S. GDP by 2034.

🌬️ Tailwinds

- Tax cuts, deregulation, and business incentives are all stimulants to economic growth, giving both consumers and businesses extra spending potential.

- AI-driven productivity gains could help reduce the negative impact of labor supply shortages.

🔍 2025 Second Half Outlook

- The global economy is expected to experience a widespread growth slowdown in the second half of 2025, but a recession is not the base case.

- New US trade policies and associated uncertainty are significant factors in this slowdown, potentially leading to lower global demand.

- Changes in perspective are only a TWEET away, so investors have to stay alert.

- Central bank actions, especially the Federal Reserve’s rate cuts (or lack thereof), will play a major role in shaping market direction.

- Despite volatility, there are still opportunities for investors, particularly in equities and core fixed income.

- US stocks: The general outlook for US stocks is cautiously optimistic, with expectations for continued, albeit slower, growth. Projections vary greatly, but analysts at Goldman Sachs, Eaton Vance, JPM and many others are positive.

- However, high valuations are a concern, potentially limiting stock pricing upside and increasing vulnerability to negative economic surprises.

- International stocks, including Europe and other developed and emerging markets, outperformed in the 1st Half 2025. This shift is notable after the U.S. market had outperformed for the past 14 years. It is important to realize that the 11% decline in the dollar YTD represented HALF the gain in international stocks, and the 2nd Half of the year is unlikely to repeat that decline.

Market uncertainty presents a challenge for strategic decision-making. Investors face two competing instincts: either staying the course or attempting to time the market. However, amid heightened volatility, making reactionary moves can be risky. Portfolio decisions should align with individual risk tolerance and individual investment time horizons.

Our current approach includes:

- Increasing diversification between value and growth, U.S. and International, and Alternatives

- Maintaining bond durations in the 3 to 6-year range, given potential inflation impact on interest rates on elevating bond yields going forward and continued volatility in 10-year bond yields.

- Staying disciplined: we have learned that the best approach for long-term investors while market headlines may evoke strong emotions, we encourage investors not to overreact to short-term swings.

Asset Allocation Adjustments

- U.S. Equities

- We are adjusting portfolios to a diversified approach in large-cap U.S. equities while incorporating more mid-cap and value exposure and giving AI-driven opportunities full consideration.

- Tariff implications on tech remain a concern, but the sector’s long-term outlook – particularly driven by AI adoption and productivity gains – must be balanced against policy uncertainties.

- International Equities

- We are maintaining equal weight position in developed international markets, while increasing value sectors.

- We are moving emerging markets from underweight to equal weight as many of the uncertainties around Asian economies and global supply chain disruptions stemming from tariffs are resolved. We continue to be underweight China.

- Fixed Income

- Fiscal pressures and high real interest rates are expected to keep US bond yields elevated.

- Bonds still play a role in portfolio diversification and offer attractive income streams

- Our strategy is holding bonds to maturity, slightly extending durations in high-yield and corporate bonds (3–6 years) to capture pricing upside when interest rates eventually ease, and to add in actively managed multi-sector funds as appropriate to portfolios.

- Fixed income alternatives offer a significant variety of strong investments, and we will continue to leverage them strategically. We have identified options in private credit that provide access to more varied investment structures across the Private Credit landscape rather than just senior loans via direct lending. These opportunities do have some liquidity restrictions, but come with lower volatility, higher returns with risk levels equal to High Yield Corporate bonds for long-term investors.

Questions?

Interested in learning more? Reach out to your advisor for a more in-depth discussion.

Not a client? No problem! Get in touch with us here: Contact Us

Important Disclaimers:

This content is intended solely to provide general information about Yes Wealth Management and its services, and to offer an overview of our investment philosophy and strategies. It is not intended to offer or deliver investment advice in any way. Direct consultation with a financial professional, who has full knowledge of your financial situation, is essential in determining how to apply these principles and strategies to your personal situation. Market data, articles and other content in this post are based on generally available information and are believed to be reliable – however, Yes Wealth Management is not in a position to be able to fully guarantee the accuracy of all cited information contained in this post. Financial professionals at Yes Wealth Management rely on a wide range of sources to determine market conditions and appropriate strategies for each client, and as such the individual sources cited in this blog should be used for descriptive and informational purposes only.

Please review our full list of disclosures here: https://yeswealth.com/important-disclosures/