Q1 2025 Market Update: Volatility, Tariffs & Outlook

The Yes Wealth Team

Current Market Perspective

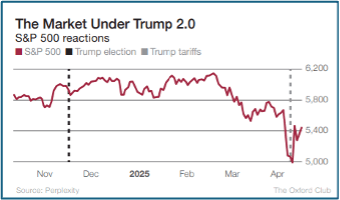

The chart above (from Invesco) reflects our interpretation of the current landscape. Tariffs have dominated headlines, especially leading up to “Liberation Day” on April 2nd. A week later, on April 9th, the U.S. announced a “pause” on new reciprocal tariffs aimed at imports. Still, a universal 10% tariff remains in place across the board, with China facing even steeper rates – starting at 125% and later raised to 145%. Some product categories, like computers and phones, have been temporarily exempted.

Here’s how the market responded:

- Markets rebound: While markets have rebounded from tariff announcement, uncertainty over tariff responses remains high. February 19th marked an all-time market high.

- Bear market territory: Since then, the Nasdaq and Dow have fallen into bear market territory (-20% from their peaks), and the S&P 500 is nearing bear market status. Volatility has surged, with the VIX hitting 60 – a level historically seen only during crises like the 2008 Financial Crisis, COVID, the 2024 Yen unwinding (triggered by rising Japanese interest rates forcing traders to liquidate leveraged equity positions), and now “Liberation Day.”

- Ongoing tariff negotiations: Talks continue with allies and trading partners, with deal-making hopefully reducing the worst-case scenarios for global trade.

- China’s response: Beijing has escalated its rhetoric in the trade war while signaling a willingness to negotiate – albeit with conditions.

- Dollar depreciation: The U.S. Dollar Index has dropped 8% year-to-date, likely due to the current administration’s trade policies. While this makes imports more costly – adding to inflation – it boosts export competitiveness, benefiting American manufacturers. Some speculate that capital outflows from U.S. fixed income may have influenced the administration’s pause on reciprocal tariffs.

- Persistent uncertainty: While the tariff details are known, their long-term impact on economic growth, inflation, and Federal Reserve policy remains unpredictable. Some analysts recommend we buy the dips, and some recommend we sell the rebounds.

- Recession concerns: Forecasts projecting a higher likelihood of recession in 2025 have gained traction, driven by the anticipated drag on global demand due to tariffs.

- Inflation trajectory: Inflation has been easing, but tariff-induced price pressures raise the question: will this inflation be transitory or persistent? Either way, the Fed’s 2% target remains elusive.

- Border restrictions and economic implications: Reduced immigration – often overlooked – has potentially negative consequences for economic growth and labor markets.

- Corporate outlook uncertainty: While pre-announcement economic data was strong, companies and analysts are now scrambling to reassess GDP growth and earnings projections. The uncomfortable reality? No one has a definitive forecast for the near-term outlook.

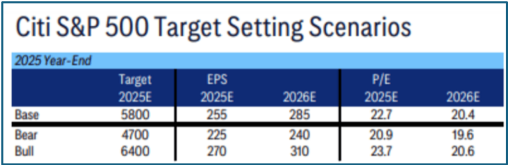

- Valuation considerations: Analysts are increasingly hedging their forecasts by outlining base-case, bullish, and bearish scenarios. Stock valuations remain dependent on earnings per share (EPS) and market multiples, which fluctuate based on GDP growth, business sentiment, and consumer behavior.

Positioning for the Future

Market uncertainty presents a challenge for strategic decision-making. However, it is especially risky to be making reactionary moves at times of heightened volatility like right now. While our approach is to make tactical adjustments, we believe portfolio decisions should align with individual risk tolerance and investment time horizons.

Our current approach includes:

- Reducing exposure to volatile tech holdings across portfolios.

- Enhancing diversification by increasing allocations to international and value stocks.

- Maintaining bond durations in the 3–5 year range, given ongoing volatility in 10-year bond yields (which have fluctuated from 4.8% in January to a low of 3.99% in April, currently at 4.36%).

- Staying disciplined – while market headlines may evoke strong emotions, we encourage investors not to overreact to short-term swings.

Asset Allocation Adjustments

- Equities:

- We have adjusted portfolios to an equal-weight allocation in large-cap U.S. equities while incorporating more mid-cap and value exposure.

- Tariff implications on tech remain a concern, but the sector’s long-term outlook – particularly driven by AI adoption and productivity gains – must be balanced against policy uncertainties.

- International Equities:

- With the U.S. dollar softening, we are shifting from an underweight position to equal weight in developed international markets.

- European and Japanese governments are expanding fiscal spending to bolster economic growth and defense, presenting opportunities.

- We remain underweight emerging markets, given heightened uncertainties around Asian economies and global supply chain disruptions stemming from tariffs.

- Fixed Income:

- Yield volatility and inflation risk demand caution in fixed income positioning.

- The elevated probability of recession further underscores the importance of fixed income in portfolio management.

- We maintain an overweight stance on select fixed income opportunities, holding bonds to maturity while slightly extending durations in high-yield and corporate bonds (3–5 years) to capture pricing upside when interest rates eventually ease.

- Fixed income alternatives – focused on market neutral, merger and acquisition (M&A) and credit event opportunities – remain valuable, low-risk investments that are not as affected by interest rate moves.

Final Thought

Market turbulence creates challenges, but disciplined investment principles remain essential. While uncertainty persists, strategic adjustments, rather than overreaction, position portfolios for resilience in the evolving policy and economic landscape.

Questions?

Interested in learning more? Reach out to your advisor for a more in-depth discussion.

Not a client? No problem! Get in touch with us here: Contact Us

Important Disclaimers:

This content is intended solely to provide general information about Yes Wealth Management and its services, and to offer an overview of our investment philosophy and strategies. It is not intended to offer or deliver investment advice in any way. Direct consultation with a financial professional, who has full knowledge of your financial situation, is essential in determining how to apply these principles and strategies to your personal situation. Market data, articles and other content in this post are based on generally available information and are believed to be reliable – however, Yes Wealth Management is not in a position to be able to fully guarantee the accuracy of all cited information contained in this post. Financial professionals at Yes Wealth Management rely on a wide range of sources to determine market conditions and appropriate strategies for each client, and as such the individual sources cited in this blog should be used for descriptive and informational purposes only.

Please review our full list of disclosures here: https://yeswealth.com/important-disclosures/